Services

What do we offer?

Edelweiss M&A Partners is a player in Corporate Finance that stands out by offering exclusively M&A consulting.

By focusing on this activity, Edelweiss M&A Partners can engage more intensely in its mandates, in order to develop quality documentation and powerful arguments, manage complex processes, make more relevant recommendations, and achieve the best result for its clients.

Why M&A consulting?

A company is a complex entity, operating in a competitive market, employing employees, offering products and/or services to a diversified clientele, sourcing from several suppliers, raising capital, generating financial results, paying taxes and being subject to a wide range of laws and regulations.

Selling or buying a business is therefore a naturally more complex process than for any other good. Even if the transaction consists of a simple exchange of shares for a negotiated amount, the sales contract and its appendices can reach a considerable volume. They are the legal translation not only of the terms of the transaction but also of the guarantees given on many parameters of this complex entity that is the company. It is the result of a complex process that had to take into account the many parameters of the operation.

A company is unique in that it is absolutely unique. Its price is therefore not defined. Even if different valuation methods, all of which have qualities and defects, make it possible to estimate a range of values for the company, the price obtained will be the result of a competitive process, a balance of power between seller and buyer (s). The M&A advisor will be essential to obtain the best financial conditions for his client.

The experienced M&A advisor is familiar with transactional processes and negotiation techniques, while in most cases the seller sells his business once in his life and the buyer makes only a few acquisitions. The client will benefit from the M&A advisor's experience in process management, and his familiarity with different tactics, acquired through numerous transactions.

Only the M&A advisor will be able to approach potential buyers in the case of a sale - or potential targets in the case of an acquisition - without disclosing the name of his client. Only when the counterparties have expressed an interest by signing a binding confidentiality agreement will the identity be disclosed. Ensuring the confidentiality of the process until the transaction is communicated is an essential task for the M&A advisor.

A transactional process may involve several specialists on either side of the transaction - lawyers, tax specialists, accountants or other experts - who will need to be coordinated and with whom to interact. It is the role of the M&A advisor, as lead advisor, to coordinate all these stakeholders and manage the flow of information and intense question-and-answer sessions, while maintaining the pressure of the timetable and the dynamics of the process.

The M&A advisor's conduct of the negotiations, as instructed by his client, allows the latter to be one step ahead, since he will make the final decision without even having been exposed to vigorous exchanges and various pressures during the negotiations. The M&A advisor thus fully plays the role of a shield by taking the necessary blows and carrying the necessary spikes, in order to protect his client and leave him the best possible role.

A close collaboration between the entrepreneur and his M&A advisor will make it possible to present the company to be sold from a favourable angle, in other words "dress the bride". Their combined knowledge of strategic and financial players will make it possible to establish a relevant list of potential buyers. In the context of an acquisition, the manager knows his market and that of his target perfectly, so that the M&A advisor will integrate certain sectoral specificities in order to optimize the management of the process.

What is M&A?

M&A or Mergers & Acquisitions is a term used in economics to refer to mergers and acquisitions of companies. The M&A activity is an indicator of the health of an economy, because it indicates the ability of some to find external growth drivers and that of others to sell a subsidiary or a company to a buyer who will be able to develop it.

In the world of SMEs, we more often talk about the sale or acquisition of companies. Instead of selling, the terms transfer of a company or even succession planning are sometimes used sparingly (from the German Nachfolgeregelung)

What is M&A consulting?

M&A advice consists of the total and continuous support of the client, whether a natural person or a legal entity, from the decision to carry out a transaction until its conclusion.

Distinct from simple brokerage or intermediation, M&A consulting is a complete service that includes the preparation or analysis of transactional files, the establishment of contacts with one or more counterparties, the coordination of other service providers, as well as the conduct of negotiations until the final transactional agreement.

Professional preparation is essential to save time and minimize risks

What are the benefits of a supported sales process?

From the moment you approach the buyers, the company is potentially exposed. It is therefore necessary to minimize the period from the marketing phase to the signing of the transaction. To do this, the M&A advisor will assist the seller in the careful preparation of the sales process. From the preparation of complete and high-quality sales documentation to the preparation of a data room, any problems must be identified and anticipated, so that due diligence by the potential buyer(s) can be carried out without friction and trust can be established.

The reason for selling a business is the first question an acquirer asks himself. The reasons are often multiple, and the M&A advisor will formulate them in a favourable and reassuring way, but also as credible as possible. The scope of the sale will be defined, including variants if necessary. Market players likely to pay a strategic premium will be carefully selected, including or excluding certain direct competitors. The M&A advisor will also propose to include financial investors (e.g. private equity funds) according to their investment strategy and the companies they have in their portfolio.

Only the M&A advisor is able to contact potential buyers directly to determine their interest in principle. If necessary, it will provide them with an anonymous profile that describes the opportunity and facilitates the buyer's task by drawing up a list of key investment arguments. Only interested parties who have signed a confidentiality agreement and then receive the detailed information memorandum.

The role of the M&A advisor is to assist the client in the preparation of a complete, very well structured sales document (called an information memorandum or "info memo") covering all the elements of the file. It will highlight the company's unique positioning in its market, its product and/or service offering and the skills of its management. It will present financial statements, standardized if necessary, as well as a business plan and projections supported by a strategy and an action plan. This document should enable potential purchasers to submit indicative, quantified and detailed offers. And above all to encourage them to set the bar as high as possible, which will inevitably have an impact on the final price.

An M&A process generates a large volume of work. Having an M&A advisor dedicated to managing the sales process relieves the company's management to focus on achieving financial objectives. It is essential that the progress of the business and the company's performance are not disrupted by the process, as otherwise the final price could suffer. Management will be involved on a relatively ad hoc basis during the process. He or she may be called upon during the preparation phase and will probably have to meet the final buyer before signing. In some cases, the selling shareholder is involved in the process, but not his management.

The involvement of an M&A advisor in the sales process is often synonymous with, or at least perceived to be synonymous with, competitive bidding through controlled auctions. The M&A advisor is empowered to impose a formal, binding process with a timetable to be respected. This control of the calendar is to the advantage of the seller, since buyers who wish to remain in the race will have to submit to it and follow the instructions of the M&A advisor. Without this timing and competitive pressure, negotiations could drag on to the advantage of the buyer, and leakages could occur to the detriment of the seller and the company.

A company is very often the fruit of a lifetime of work. Selling your company is a heavy and emotionally charged decision for any entrepreneur. However, a sale process is anything but a long and quiet river. It is an intense period that often has ups and downs, like a roller coaster, and where tensions are sometimes exacerbated. It is therefore important that the seller is not directly exposed to the ups and downs of the process, to the challenges posed by the counterparty during the due diligence sessions, or to the confrontations during the negotiations. A certain phlegm may be indicated in certain cases, even some distancing, incompatible with the healthy identification of the entrepreneur with his company.

A process that appears formal and binding does not mean inflexible. The M&A advisor will subtly adapt the dynamics of the process to the number of participants, since this number is not known to them. The schedule will naturally be adapted to the availability of the seller and his management. If necessary, confidential data will be disclosed gradually, as the process progresses, in order to keep the most sensitive information, such as customer names, for the final purchaser. An exclusivity period will be provided for the last phase, if necessary.

How is a sales process structured?

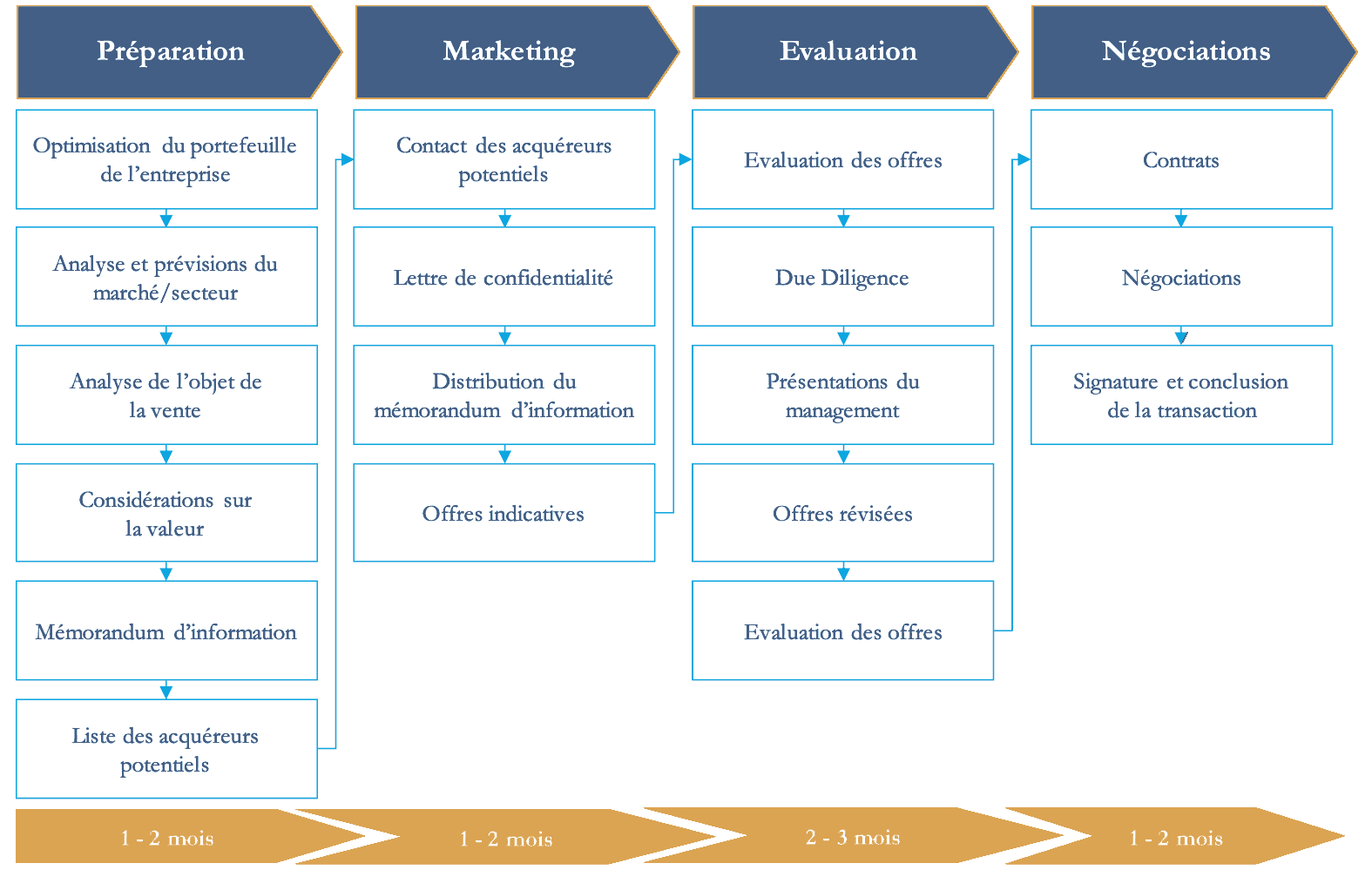

A sales process is essentially divided into four phases that may overlap.

The sales documentation and the list of potential buyers are prepared with the client during the "Preparation" phase. The "Marketing" phase is the approach of the parties, first of all anonymously, followed by the distribution of the information memorandum to the parties who have signed a confidentiality agreement. The receipt of indicative offers, an in-depth discussion session with certain parties and the opening of a data room accessible to buyers constitute the "Evaluation" phase. Finally, the "Negotiations", with one or more parties, of the main terms of the agreement and then detailed elements until the signature with the buyer of a purchase/sale contract. Such a process typically takes 6 to 9 months, but can be lengthened depending on the circumstances.

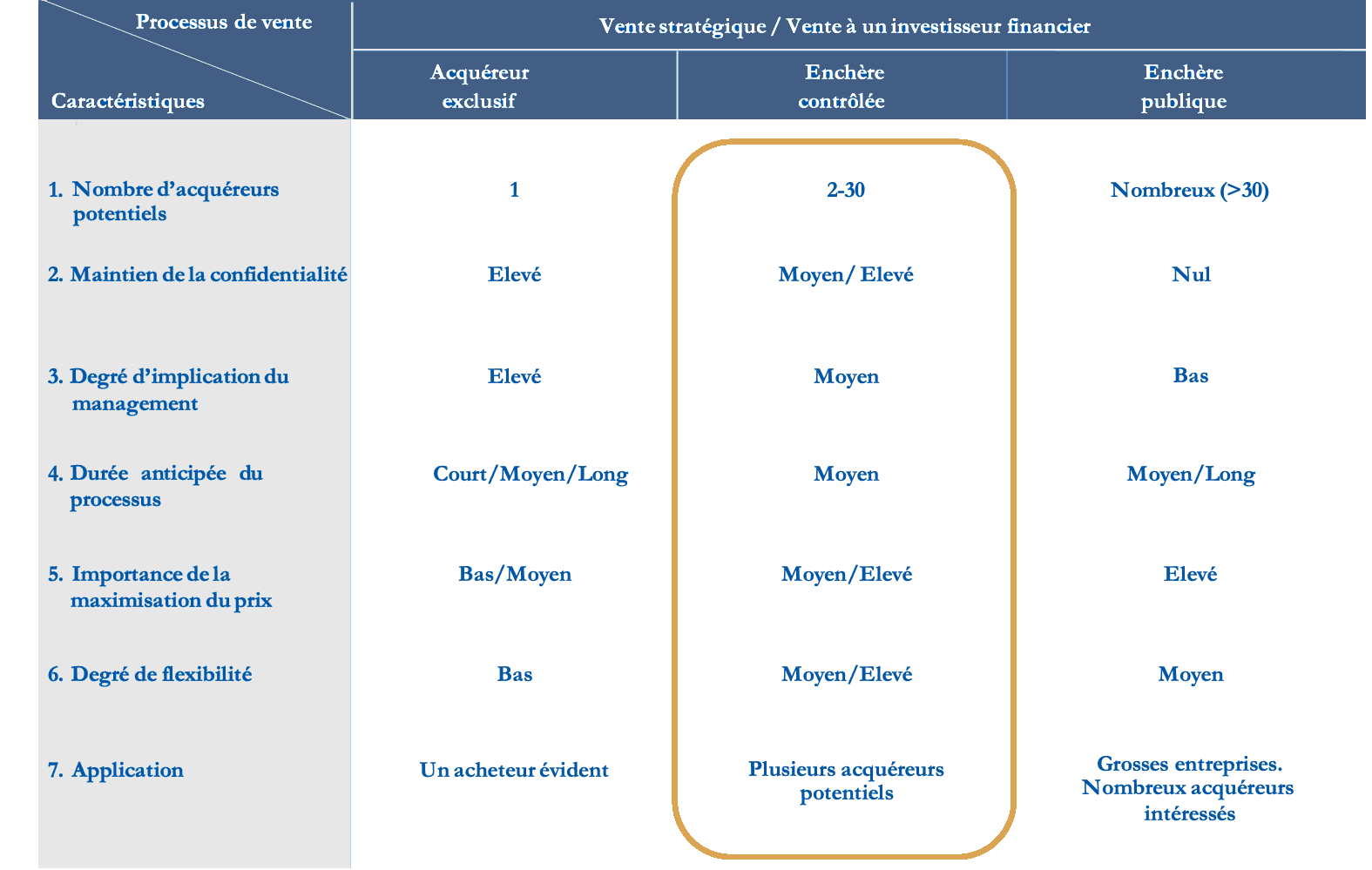

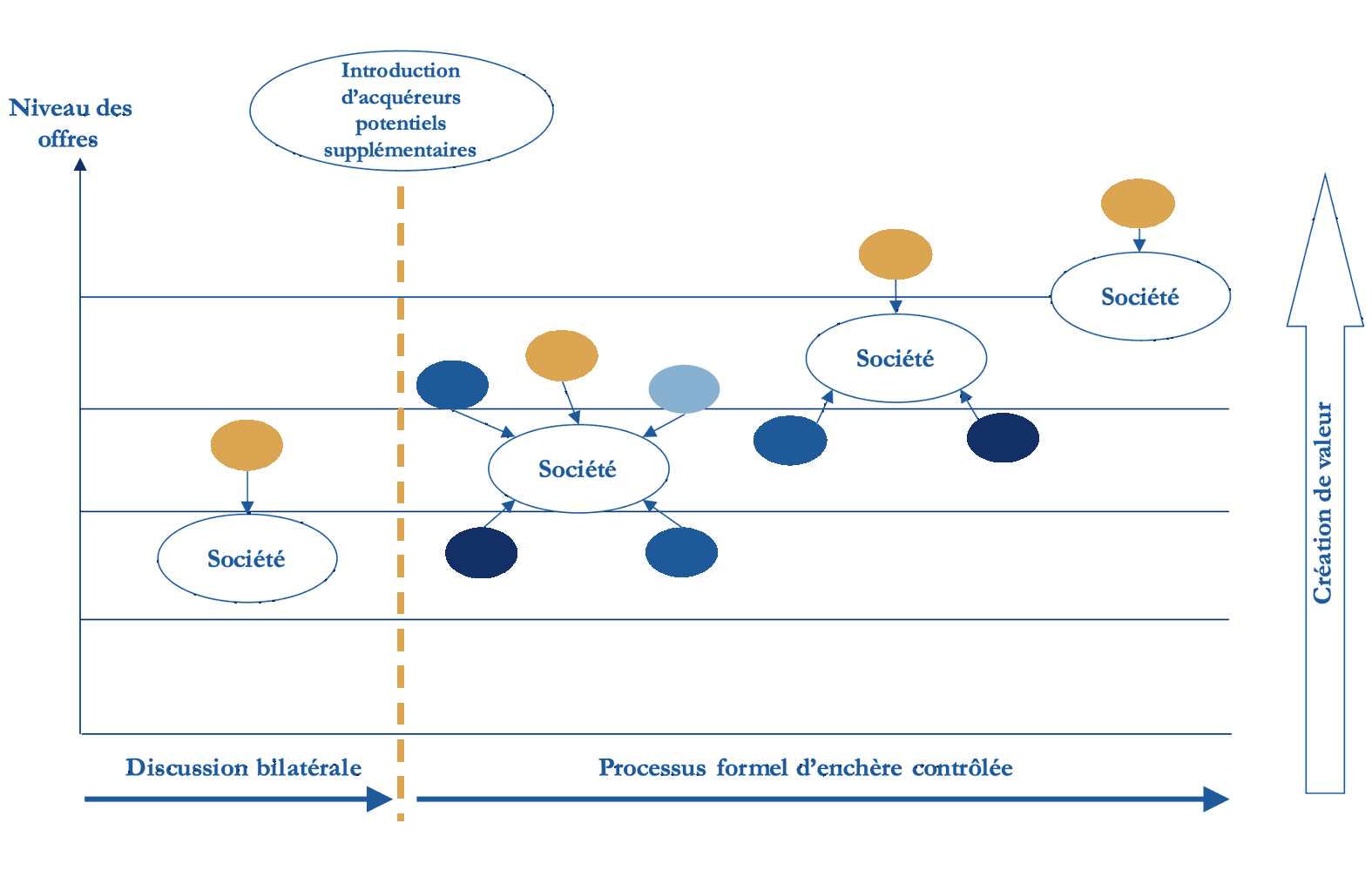

A controlled auction process combines the best of both worlds: the confidentiality of an exclusive process between two parties on the one hand, and the competition that is stimulated in public auctions on the other. This means introducing competition to maximize price, while maintaining confidentiality so as not to disrupt the company and its ecosystem during the sales process. Only an M&A advisor can manage a process of such intensity where interactions with multiple counterparties take place in parallel and simultaneously.